Demand for gold in India tepid despite fall in prices to a 5-year low

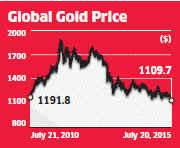

KOLKATA & MUMBAI: Gold prices fell to Rs 25,000 per 10 gm Monday morning triggered by a drop in overseas bullion to a five-year low of $1,080 an ounce (31.10 gms). Gold plummeted to $1,080 from $1,132 an ounce in a matter of minutes at around 11.30 am after 5 tonnes of bullion were offloaded in the Chinese market.

But the drop in prices has not yet triggered much demand in India which consumes 850-900 tonnes of the yellow metal annually. Prices soon bounced back to $1,109 per ounce and then traded at around $1,115 an ounce intraday.

But the drop in prices has not yet triggered much demand in India which consumes 850-900 tonnes of the yellow metal annually. Prices soon bounced back to $1,109 per ounce and then traded at around $1,115 an ounce intraday.Taking the international cue, MCX gold touched a low of Rs 24,904 per 10 gm for the August contract, down 2.3% from its Friday close and the lowest since having hit Rs 24,830 on June 28, 2013. Bullion then bounced back to Rs 25,113 per 10 gm.

In the spot market, gold traded atRs 25,500 per 10 gm intraday.

"The price drop will not trigger a rise in imports as banks and the trade have huge stocks of gold with them," said Manish Jain, chairman, Gems & Jewellery Trade Federation.

The sharp fall of gold in rupee terms to a two-year low might not translate into an immediate rise in demand after the worst showing in four years this May and June, although senior officials inTanishq and Senco Gold have reported an improvement in sentiment in the past week.

Demand had fallen due to persistently high price of the metal at a time when retail level inflation has eaten into household savings. Also, the economic recovery on the ground has not begun in earnest.

"Investors are not keen to participate in the gold market as the precious metal has given negative returns in the last two years. They are investing in equity and other financial instruments where they are getting good returns. Those who have weddings in the family in the November-December may buy some jewellery right now," said Bachhraj Bamalwa, director, Nemichand Bamalwa & Sons. However, leading jewellers and a banker sounded optimistic amid the fall.

"There has surely been an improvement in customer sentiment since the past week," said Sandeep Kulhalli, senior vice president - retail and marketing - Tanishq, the jewellery brand of Titan Company.

"Gold looks attractive at current levels and we hope things continue to look positive for jewellery buyers." Kulhalli's views were echoed by Suvankar Sen, ED, Senco Gold. "We've seen the worst May-June in four years. But in the last two days, the sharp fall in rate has resulted in an improvement in footfalls at many of our 68 stores. After this rather dull period, attractive prices, we hope, will pull in more people to buy jewellery ahead of the wedding season that begins in October."

Rajesh Cheruvu, CIO (India), RBS Private Banking, feels the sharp drop in price could spark a revival in consumption-led demand.

However, Ketan Shroff, spokesperson India Bullion & Jewellers Association (IBJA), a leading trade body, warned that a fall in rupee could erode the decline in gold rates to some extent.

"A stronger dollar could also cushion, to an extent, a fall in gold as a stronger dollar mutes the dollar returns of foreign investors in Indian stock markets. Any pullout of funds could weaken the rupee and that could potentially play spoilsport to a fall in gold price internationally," said Shroff.

No comments:

Post a Comment