India's Chabahar Port in Iran is Operational. Modi Govt's strategy to ferry goods to Afghanistan bypassing Pakistan is operational.

A former port named Tis in Chabahar's neighborhood dates back to 2500 BC, known in Alexander's conquests and recorded that the sea coast of India commences with Tis.

In May 2016, Narendra Modi became the first Indian prime minister in 15 years to visit Iran, and during his visit, he pledged up to $500 million to develop and operate Iran's Chabahar port as part of a trilateral engagement between India, Iran and Afghanistan.

India signed a series of twelve memorandums of understanding which centered upon the Port of Chabahar. The trilateral transit agreement signed by India, Iran and Afghanistan allows Indian goods to reach Afghanistan through Iran. It links ports in the western coast of India to the Chabahar port and covers the road and rail links between Chabahar and the Afghan border

In August 2017, Indian Union Minister of Ports, Nitin Gadkari, informed at an event in Iran that the civil work at Chabahar port developed by India is complete, and the Indian government is ordering INR 400 crores (USD63 million) worth of mechanised equipment and cranes, and the port will be operational in 2018 to export Indian wheat to Afghanistan. after meeting with Iranian President Hasan Rouhani, he said "now, we are building a railway line in Iran. From Chabhar, we can go to Afghanistan, Uzbekistan and Russia."

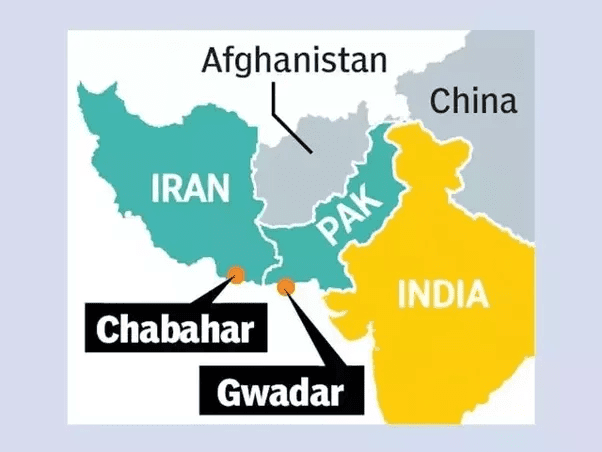

India's Chabahar Port deal is seen as "a counter to the China-Pakistan Economic Corridor," as it has "broken through the strategic encirclement by China and Pakistan."

Pakistani military commentators have characterised the alliance between India, Iran, and Afghanistan as a "security threat to Pakistan", and it had "ominous and far-reaching implications" to the region. Segments of the Pakistani press bemoaned the country's increasing "isolationism"

WHY CHABAHAR PORT IS CRUCIAL FOR INDIA

The first and foremost significance of the Chabahar port is the fact that India can bypass Pakistan in transporting goods to Afghanistan. Chabahar port will boost India's access to Iran, the key gateway to the International North-South Transport Corridor that has sea, rail and road routes between India, Russia, Iran, Europe and Central Asia.

Chabahar port will be beneficial to India in countering Chinese presence in the Arabian Sea which China is trying to ensure by helping Pakistan develop the Gwadar port. Gwadar port is less than 400 km from Chabahar by road and 100 km by sea.

With Chabahar port being developed and operated by India, Iran also becomes a military ally to India. Chabahar could be used in case China decides to flex its navy muscles by stationing ships in Gwadar port to reckon its upper hand in the Indian Ocean, Persian Gulf and Middle East.

With Chabahar port becoming functional, there will be a significant boost in the import of iron ore, sugar and rice to India. The import cost of oil to India will also see a considerable decline. India has already increased its crude purchase from Iran since the West imposed ban on Iran was lifted.

Chabahar port will ensure in the establishment of a politically sustainable connectivity between India and Afghanistan. This is will, in turn, lead to better economic ties between the two countries.

From a diplomatic perspective, Chabahar port could be used as a point from where humanitarian operations could be coordinated.

The Zaranj-Delaram road constructed by India in 2009 can give access to Afghanistan's Garland Highway, setting up road access to four major cities in Afghanistan - Herat, Kandahar, Kabul and Mazar-e-Sharif.

Officials from the Afghanistan Chamber of Commerce and Industries (ACCI) said India will send its first cargo of wheat to Afghanistan through Chabahar Port in Iran.

The ACCI officials said the move to send in at least 130,000 tons of wheat to Afghanistan will strengthen trade ties between the two countries.

“This process is crucial for strengthening trade and transit relations of Afghanistan with India and Iran. We will continue our efforts to provide better grounds for increasing trade activities,” the ACCI deputy head for trade, Kamila Sediqi said.

“Many (Afghan) investors will try to do business through Chabahar once the process kicks off. This will help investors send their goods to India and import goods through a closer route,” the CEO of the ACCI, Atiqullah Nasrat said.

This comes after President Ashraf Ghani said during his trip to India this week that Afghanistan appreciated India’s move to send in the wheat to the country.