‘GSTN-a PC time bomb’: Why Subramanian Swamy thinks GST won’t survive in SCSaubhadra Chatterji, Hindustan Times, New Delhi | Updated: Aug 09, 2016 10:17 IST http://www.hindustantimes.com/india-news/gstn-a-pc-time-bomb-why-subramanian-swamy-thinks-gst-won-t-survive-in-sc/story-kn8VgDN1xmDjQd7rQIrYLN.html

File photo of BJP leader Subramanian Swamy. Swamy, a Harvard-returned economist, has not been a vocal supporter for the Goods and Services Tax. (Anshuman Poyrekar / HT Photo )

The ruling NDA government, economists and even the opposition is optimistic about the Goods and Services Tax. But Bharatiya Janata Party (BJP) leader Subramanian Swamy is not.

A day after the 122nd constitution amendment bill was cleared by Parliament, ending the legislation’s five year-long hibernation, Swamy raised questions if the future GST act can withstand legal scrutiny.

“I am confident Smart Cities will be a reality in 2018 but not sure if the future GST Act can survive in SC because of GSTN-- a PC time bomb,” Swamy tweeted on Tuesday morning.

Follow

Subramanian Swamy

Subramanian Swamy

✔@Swamy39

I am confident Smart Cities will be a reality in 2018 but not sure if the future GST Act can survive in SC because of GSTN-- a PC time bomb7:17 AM - 9 Aug 2016

By “PC era”, Swamy meant the duration when

https://www.pgurus.com/gstn-floated-upa-2013-private-ownership-51-percent/

The decision of UPA Govt to allow a majority stake by private entities in a non-profit (GSTN) is bafflingWas it clairvoyance on part of the UPA Government to float a Section 25 company in 2013, called Goods and Services Tax Network (GSTN) to control the accounting and tax collection management of Goods and Services Tax (GST)?

The decision of UPA Govt to allow a majority stake by private entities in a non-profit (GSTN) is bafflingWas it clairvoyance on part of the UPA Government to float a Section 25 company in 2013, called Goods and Services Tax Network (GSTN) to control the accounting and tax collection management of Goods and Services Tax (GST)?

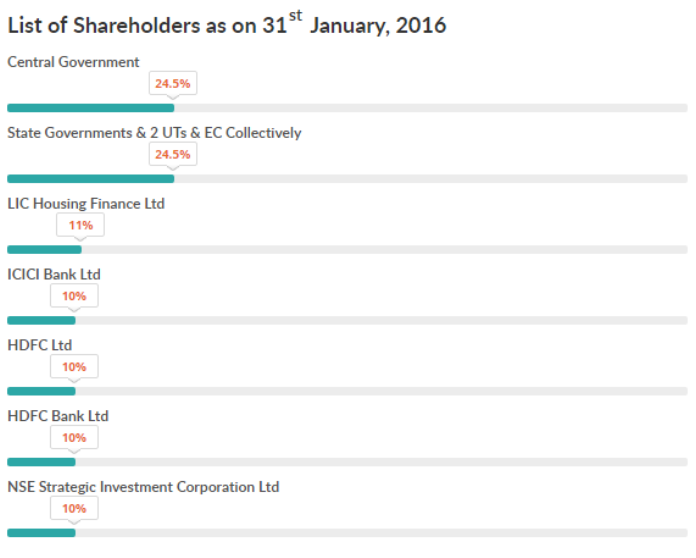

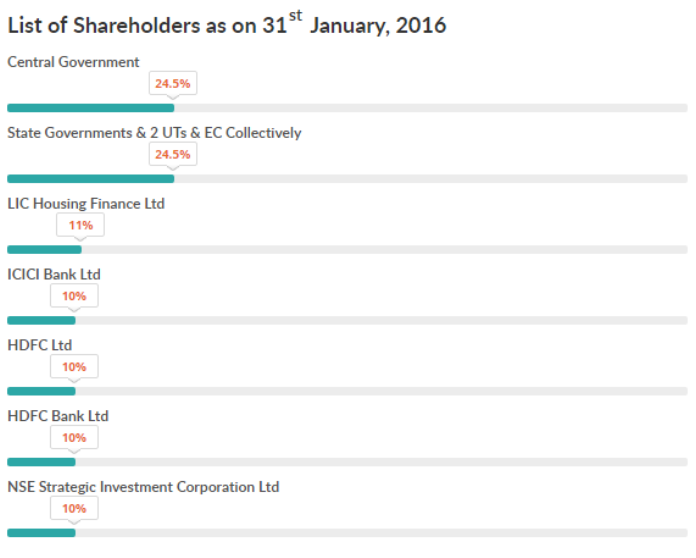

For a government that tended to be slow, it was a swift move to float this company with 51 percent private shares (see the graphic below).

Centre and State Governments have only 49 percent in GSTN. Being a Section 25 company, GSTN is a not-for-profit organization. Then why do private entities have a majority stake in it? What is in it for them? As of Jan 31st, 2016 the list of shareholders in GSTN is:

Creation of GST involves Constitutional Amendments and this GST administration and tax management company should have been ideally created by a consortium of Centre and State Governments. After all they have all the data and it is a matter of pulling them together for computation of GST. The question then is why the then Finance Ministry under P Chidambaram took this decision to outsource such a strategic activity to the private sector?

Creation of GST involves Constitutional Amendments and this GST administration and tax management company should have been ideally created by a consortium of Centre and State Governments. After all they have all the data and it is a matter of pulling them together for computation of GST. The question then is why the then Finance Ministry under P Chidambaram took this decision to outsource such a strategic activity to the private sector?

On first looks, the most significant player in this tax collection effort should be the one who has the Data. In this case, that would be the Central and State Governments. Everything else such as adjusting the percentage of GST for various states is just a matter of programming, which could have been done by the Government itself. After all, it has codified Income Tax! This cannot be more complicated than that!

A closer look at the private partners reveals that entities such as the HDFC Bank, ICICI Bank and LIC Housing Finance Limited have shareholding of several foreign investments companies. In LIC Housing Finance Limited, among the 59 percent private shares, Abu Dhabi Investment Authority, Bank of Muscat, Mawer International Equity Fund, ICICI Prudential are the major private players.

In our opinion, tax administration is a sensitive matter dealing with sensitive information. Being a shareholder, would this automatically mean that HDFC and ICICI will be the bankers of public money collected through taxes? If yes, that would be a large amount of money passing through these banks! Also has the Home Ministry approved GSTN operators to allow them access to tax data?

The GST Bill has a long way to go. Only the constitutional amendments have been passed in the Parliament. States have to come on board and the final bill needs to be drafted and agreed to be made into law. Adequate security has to be established to ensure that this data does not fall in the wrong hands. There is still time to put the right structure in place. Will the Narendra Modi government do it?

File photo of BJP leader Subramanian Swamy. Swamy, a Harvard-returned economist, has not been a vocal supporter for the Goods and Services Tax. (Anshuman Poyrekar / HT Photo )

The ruling NDA government, economists and even the opposition is optimistic about the Goods and Services Tax. But Bharatiya Janata Party (BJP) leader Subramanian Swamy is not.

A day after the 122nd constitution amendment bill was cleared by Parliament, ending the legislation’s five year-long hibernation, Swamy raised questions if the future GST act can withstand legal scrutiny.

“I am confident Smart Cities will be a reality in 2018 but not sure if the future GST Act can survive in SC because of GSTN-- a PC time bomb,” Swamy tweeted on Tuesday morning.

Follow

Subramanian Swamy

Subramanian Swamy ✔@Swamy39

I am confident Smart Cities will be a reality in 2018 but not sure if the future GST Act can survive in SC because of GSTN-- a PC time bomb7:17 AM - 9 Aug 2016

By “PC era”, Swamy meant the duration when

P. Chidambaram was the finance minister of the previous UPA government.

The Goods and Services Tax Network (GSTN) is the special purpose vehicle that was formed to create the information technology backbone to the roll-out of the new, nationwide tax that will replace myriad local levies.

In the GSTN, the government of India holds 24.5 % share. State governments, including NCT of Delhi and Puducherry, and the Empowered Committee of State Finance Ministers, together hold another 24.5%. Balance 51% equity is with non-government financial institutions.

Swamy, a Harvard-returned economist, has not been a vocal supporter for the GST. He is also known to have a bitter equation with Chidambaram who is now in the same Rajya Sabha, where Swamy is a member. During the seven-hour-long debate on the GST bill in the Upper House last week, the BJP did not allow Swamy to participate.

The BJP leader also re-tweeted an article that questioned why the tax collection management of GST has been given to an entity where private players have a majority stake.

On Monday, Prime Minister Narendra Modi said the GST bill will liberate people from “tax terrorism” as the Lok Sabha passed a Constitution amendment bill for GST.

Modi also said the consumer will be “king” in the new system and hailed the new tax regime as “pro-poor” and “pro-consumer”.

The Goods and Services Tax Network (GSTN) is the special purpose vehicle that was formed to create the information technology backbone to the roll-out of the new, nationwide tax that will replace myriad local levies.

In the GSTN, the government of India holds 24.5 % share. State governments, including NCT of Delhi and Puducherry, and the Empowered Committee of State Finance Ministers, together hold another 24.5%. Balance 51% equity is with non-government financial institutions.

Swamy, a Harvard-returned economist, has not been a vocal supporter for the GST. He is also known to have a bitter equation with Chidambaram who is now in the same Rajya Sabha, where Swamy is a member. During the seven-hour-long debate on the GST bill in the Upper House last week, the BJP did not allow Swamy to participate.

The BJP leader also re-tweeted an article that questioned why the tax collection management of GST has been given to an entity where private players have a majority stake.

On Monday, Prime Minister Narendra Modi said the GST bill will liberate people from “tax terrorism” as the Lok Sabha passed a Constitution amendment bill for GST.

Modi also said the consumer will be “king” in the new system and hailed the new tax regime as “pro-poor” and “pro-consumer”.

Why was GSTN floated by UPA in 2013, with private ownership of 51 percent?

The decision of UPA Govt to allow a majority stake by private entities in a non-profit (GSTN) is bafflingBy Team PGurus - August 7, 2016https://www.pgurus.com/gstn-floated-upa-2013-private-ownership-51-percent/

The decision of UPA Govt to allow a majority stake by private entities in a non-profit (GSTN) is bafflingWas it clairvoyance on part of the UPA Government to float a Section 25 company in 2013, called Goods and Services Tax Network (GSTN) to control the accounting and tax collection management of Goods and Services Tax (GST)?

The decision of UPA Govt to allow a majority stake by private entities in a non-profit (GSTN) is bafflingWas it clairvoyance on part of the UPA Government to float a Section 25 company in 2013, called Goods and Services Tax Network (GSTN) to control the accounting and tax collection management of Goods and Services Tax (GST)?  Creation of GST involves Constitutional Amendments and this GST administration and tax management company should have been ideally created by a consortium of Centre and State Governments. After all they have all the data and it is a matter of pulling them together for computation of GST. The question then is why the then Finance Ministry under P Chidambaram took this decision to outsource such a strategic activity to the private sector?

Creation of GST involves Constitutional Amendments and this GST administration and tax management company should have been ideally created by a consortium of Centre and State Governments. After all they have all the data and it is a matter of pulling them together for computation of GST. The question then is why the then Finance Ministry under P Chidambaram took this decision to outsource such a strategic activity to the private sector?On first looks, the most significant player in this tax collection effort should be the one who has the Data. In this case, that would be the Central and State Governments. Everything else such as adjusting the percentage of GST for various states is just a matter of programming, which could have been done by the Government itself. After all, it has codified Income Tax! This cannot be more complicated than that!

A closer look at the private partners reveals that entities such as the HDFC Bank, ICICI Bank and LIC Housing Finance Limited have shareholding of several foreign investments companies. In LIC Housing Finance Limited, among the 59 percent private shares, Abu Dhabi Investment Authority, Bank of Muscat, Mawer International Equity Fund, ICICI Prudential are the major private players.

In our opinion, tax administration is a sensitive matter dealing with sensitive information. Being a shareholder, would this automatically mean that HDFC and ICICI will be the bankers of public money collected through taxes? If yes, that would be a large amount of money passing through these banks! Also has the Home Ministry approved GSTN operators to allow them access to tax data?

The GST Bill has a long way to go. Only the constitutional amendments have been passed in the Parliament. States have to come on board and the final bill needs to be drafted and agreed to be made into law. Adequate security has to be established to ensure that this data does not fall in the wrong hands. There is still time to put the right structure in place. Will the Narendra Modi government do it?

No comments:

Post a Comment