8th Nov 2016-8pm, (One year back)-this was a memorable day in India, as important as Independence Day. Finally there was a Prime Minister in this country who could hold the corrupt by the balls and toss them up. The network of corrupt class that had entrenched themselves deeply into the system since independence was brought to their knees.

On this day in Indian History, the first concrete measure to tackle corruption was initiated. The scale of it was unprecedented. A lot more needs to be done in a country burdened by its babudom and crooked political & financial network. To say that Demonetization was a resounding success is an understatement.

This day, this time and this generation will be registered in History as the start of Independent India's fight against corruption, and to bring accountability into Public Life. PM Modi will credited as the person who was bold enough to start it, against all odds, against all opposition.

1) Demonetization exposed the extent of the corrupt network that was firmly in place all over India. Immediately after the Rs.2,000 note was released, it was grabbed mostly by the corrupt infrastructure. But it also turned into a beautiful honey trap. The taxman had another pink trail to follow!

2) Around 35,000 of the 2.24 lakh shell companies deposited Rs 17,000 crore post the demonetisation drive only to withdraw it later, thus making their objectives clear.

In one such case an account with a negative balance just before the demonetisation day saw Rs.2,484 crore being deposited and withdrawn soon after. 2 lakh such accounts were identified. Its been recorded that Rs.35,000 crore of money has entered the banking system but there is no money trail to it. This money is over twice the amount that went missing post-demonetisation. Many of the 35,000 companies have been struck off from the registry, but their promoters and executives will still be held responsible. Around 300,000 directors have been disqualified because the companies on whose boards they sit, did not comply with the statutory requirement of filing annual returns.

3)Serious Fraud Investigation Office (SFIO), a multi-disciplinary body attached to the corporate affairs ministry, has been authorized to make arrests for certain company law violations. The corporate affairs ministry has also asked the finance ministry to make these offences under the Prevention of Money Laundering Act.

4) 17.73 lakh suspicious cases involving Rs 3.68 lakh crore have been identified by the taxman in 23.22 lakh bank accounts post demonetisation. In come tax department has already issued notices to 70,000 entities who deposited over Rs 50 lakh in cash in banks but chose not to file tax returns or respond to the relevant Income Tax Department advisories, the sources said. These notices will be issued under Section 142 (1) of the I-T Act (inquiry before assessment), they said. Similarly, about 30,000 scrutiny notices will be issued to those whose deposits and tax returns were found to be starkly “deviant” from their past behaviour or their accounts showed huge monetary transactions post demonetisation, they added. As many as 20,572 tax returns have been selected for the scrutiny procedure by the department post demonetisation, declared by the government on November 8 last year. The rest of the scrutiny notices will be issued in due course, they added.

5) The I-T department had conducted 900 searches between November 9, 2016, and March this year, leading to seizure of assets worth Rs 900 crore, including Rs 636 crore in cash. The searched led to the disclosure of Rs 7,961 crore undisclosed income, according to the official data. During the same period, the department conducted 8,239 survey operations leading to detection of Rs 6,745 crore of black money.

6) Total number of all returns (electronic + paper) filed during the entire Financial Year 2016-17 was 5.43 crore which is 17.3% more than the returns filed during FY 2015-16.

7) Collection of advance tax under personal income tax (i.e. other than Corporate Tax) as on 05.08.2017 showed a growth of about 41.79 per cent over the corresponding period in FY 2016-2017."

8) 14,000 properties of more than Rs.1 crore each have been identified where persons have not even filed Income Tax Returns.

9) 1,300 high-risk cases where people's real estate deals and land purchases did not match with their tax profiles. The total value of these property transaction was more than Rs 6,000 crore.

10) 20 per cent reduction in cash relative to what might have been without demonetisation," Subramanian said adding that the cash-to-GDP ratio has come down by 1.6 percentage points."

11) Almost the entire cash holding of the economy now has an address.

There are some who think that Demonetization was a good idea but badly executed. The very fact that most of the Rs.2000 notes were lapped up by the nexus of crooks in the system is proof that little could have been done from within the system that would not have gone unnoticed by these foxes and vultures.

Besides, its almost impossible to refit the ATMs across the country to dispense either only Rs.100 notes or to dispense the new notes, without the massive crooked network noticing it

An ATM has drawers called cassettes filled with money. Usually, an ATM holds four cassettes. (There are some with three and two as well.) Many ATMs have 2 cassettes filled with ₹1,000 notes, one with ₹500 notes and one with ₹100 notes. On an average, a cassette's maximum capacity is 2,000 notes.

Now, each cassette is also calibrated to act in a certain manner to handle a certain currency. It works with the software and the whole ATM machine in tandem to identify features such as weight, dimensions, design and security features of a currency and dispense them.

The magnitude of the operation can be estimated from the fact that there are over 2 lakh ATMs spread across the country. The average transaction size per day is ₹4,000 and the average number of transactions is 125 per ATM. So, the ATMs handle over ₹10,000 crore in currency everyday.

To even think that Demonetization could have been executed across India by first preparing the ATMs is an absurdity. Even if the printing and circulation of Rs.100 notes was increased six months in advance, definitely someone would have made an equation.

There are some who say that the existing ways and machinery available could have been used to clean up the system. The absolute truth is nothing was done so far and the existing machinery was not going to do this job. PM Modi who was sailing smooth with hardly any opposition did not have to indulge in something as massive and complicated as this to spoil his own political career.

There are some who say that the existing ways and machinery available could have been used to clean up the system. The absolute truth is nothing was done so far and the existing machinery was not going to do this job. PM Modi who was sailing smooth with hardly any opposition did not have to indulge in something as massive and complicated as this to spoil his own political career.

Politically, Demonetization was executed at the Perfect Time. The 2nd year of the Modi's term, he undertook this unprecedented massive exercise when the economy was cruising in overdrive. One year down the line, the country has already absorbed the worst part of the expected economic consequences and while the squeamish Lutyens were crying crocodile tears for the poor, most of the people in the country have got on and the economy has rebound, picked up and become more accountable. By 2019, when the next elections come, PM Modi will be sitting pretty with a stronger economy with better financial systems in place.

2G - CWG -

CWG -  Coalgate -

Coalgate -  National Herald -

National Herald -

2G -

CWG -

CWG -  Coalgate -

Coalgate -  National Herald -

National Herald -

Seriously, the opposition in India has been left with no strategy to take on the Modi government. Rahul Gandhi standing in line for withdrawing money and the now silent Kejri getting shouted down Modi Modi Modi, did offer good entertainment.

Narendra Modi took a huge political risk with Demo by doing something that would affect each person and not just one section and with that he pressed the reset button on corruption. For a deeply corrupt nation, any anti-corruption move has to be multi-pronged and results will take at least half a decade to play out. But the early successes are showing up in the data.

The Tom and Jerry show

These are two examples from the 10 given by the tax department that give the methods adopted for conversion of unaccounted cash by various categories of people.

Hyderabad-Based Doctor: The doctor was found to have deposited more than Rs11 crore in specified bank notes after 8 November 2016 in three bank accounts. During questioning, the individual could not provide any document to substantiate the source of the deposits, which was later admitted as undisclosed income. Prohibitory orders were initially placed on the bank accounts, which were later lifted and a sum of Rs7.50 crore was seized.

Demonetisation also forced government employees to deposit unaccounted cash in their bank accounts

Government employee in Bhubaneswar: A government employee was searched on the basis of information on unexplained cash deposits into the accounts maintained with various banks in his own name as well as in the name of his family members. Investigations also revealed that his wife, a homemaker with no ascertainable sources of income, had purchased land in Bhubaneswar by making a cash payment of Rs53 lakh, the sources of which could not be explained. A total cash of Rs2.28 crore has been seized in this case. The matter has also been referred to the state vigilance department.

http://www.livemint.com/Opinion/wxDyTt00PCTYcn5AQSzsEK/Demo-one-year-later-Success-or-failure.html

Has there been a dent in corruption and black money? Anecdotal stories say that high-level corruption in the central government is gone, but the cancer of graft elsewhere in the system still thrives. It is unrealistic to expect the deep-rooted habit of graft to disappear overnight, but at least there is serious political will behind the anti-corruption war in India today. What of black money, or money on which income tax has not been paid? Black money is back in the system—talk to any builder (real estate is the biggest sump of black money and talking to builders is a quick way to figure out if cash deals are back) and they say it is as if Demo never happened. But they admit to the cash ratio going down and the fear factor lurking at the back of every deal.

Look next at the data on currency in the system and digitisation. Reserve Bank of India data shows that currency held by the public is now down almost 10% as compared to last year. Currency in circulation is down by 17%, says the ministry of finance; this means that more than Rs3 trillion, which was earlier cash in circulation, is now part of the formal financial system. Financialisation of household savings got a hard push with Demo with assets of life insurance products and mutual funds showing an uptick post Demo, and cash-based real estate is still to recover.

Digitisation of transactions is growing with the value of NEFT (National Electronic Funds Transfer) transactions rising from Rs9.5 trillion to Rs12.5 trillion over a year. Digital transactions leave a trail and the more India moves to such transactions, the bigger is the blow to black money.

A metric to measure the impact of Demo on black money would be tax compliance. Rising tax compliance is a win for the war on corruption. A ministry of finance press release (you can see it here: bit.ly/2y9tRMr) says that the number of returns filed as of August 2017 was up almost 25% compared to an increase of about 10% a year ago. The Economic Survey puts the number of new taxpayers due to Demo at about 540,000 in FY17, with a possible rise in returned income at Rs10,587 crore. You can see the table here: bit.ly/2vtrq6W. These are clear short-term gains in tax compliance and will need a sustained effort to keep the momentum going.

The finance minister said while the 10 years of United Progressive Alliance (UPA) were characterised by “policy paralysis”, the Modi dispensation introducted structural reforms to make India a developed nation and give it a cleaner economy.

Jaitley said the BJP believes that status quo in economy needed to be shaken up to end corruption. Taking on the Congress over the issue, Jaitley said the previous Congress governments never took any such big step against black money.

“The Congress’ main aim is to serve the family whereas BJP wants to serve the nation.” Elaborating on the benefits of demonetisation, the minister said it was aimed at making India a more formal economy with a broader tax base and less cash in the system. “Less cash in the system may not end corruption but makes corruption difficult,” he said, adding terror funding got “squeezed” post-demonetisation.

economictimes.indiatimes.com

Demonetisation: Modi magic holds, people still back demonetisation: ET online survey

For a year since November 8 when Prime Minister Narendra Modi announced demonetisation in a televised address to the nation, there has been endless criticism of the shock decision to ban high-currency notes.

Demonetisation: Modi magic holds, people still back demonetisation: ET online survey

For a year since November 8 when Prime Minister Narendra Modi announced demonetisation in a televised address to the nation, there has been endless criticism of the shock decision to ban high-currency notes.

Even though Modi seemed to have gained electorally from his decision, indicating popular support, he has been held responsible by a number of experts for job losses, bringing the GDP down and crippling small businesses with his ill-conceived move. Eminent economists such as former RBI chief Raghuram Rajan too has spoken out against the move.

But after a year—enough time to see the results of demonetisation—more people support Modi on demonetisation than those who criticise him.

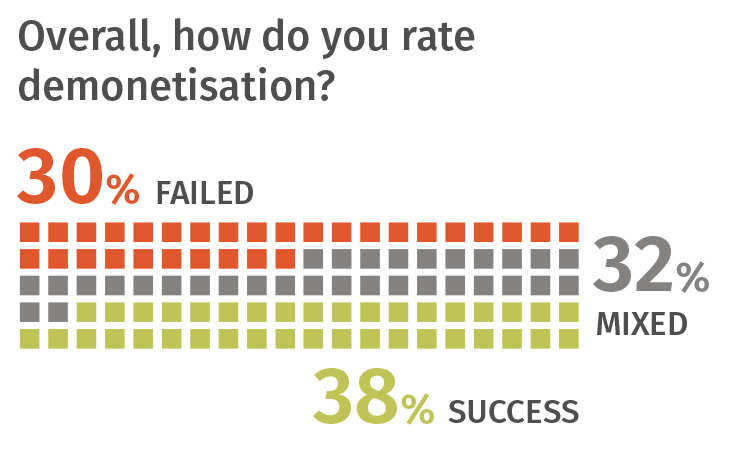

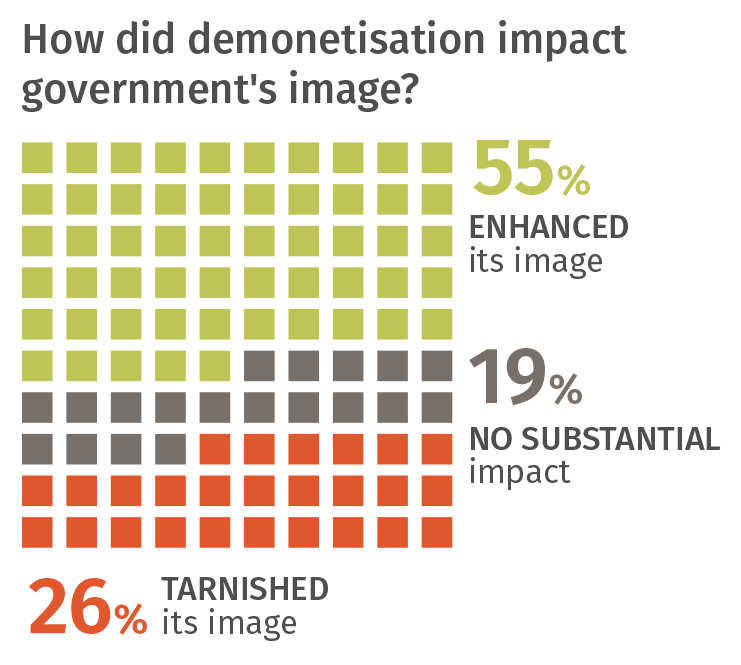

An online survey conducted by Economictimes.com to mark the anniversary of demonetisation showed significant support for Modi's controversial move. In response to the question, 'Overall, how do you rate demonetisation?', 38% said it was a success. 30% said it had mixed results. Only 32% said it was a failure.

A total of over 10,000 ET Online readers had responded to the survey.

But after a year—enough time to see the results of demonetisation—more people support Modi on demonetisation than those who criticise him.

An online survey conducted by Economictimes.com to mark the anniversary of demonetisation showed significant support for Modi's controversial move. In response to the question, 'Overall, how do you rate demonetisation?', 38% said it was a success. 30% said it had mixed results. Only 32% said it was a failure.

A total of over 10,000 ET Online readers had responded to the survey.

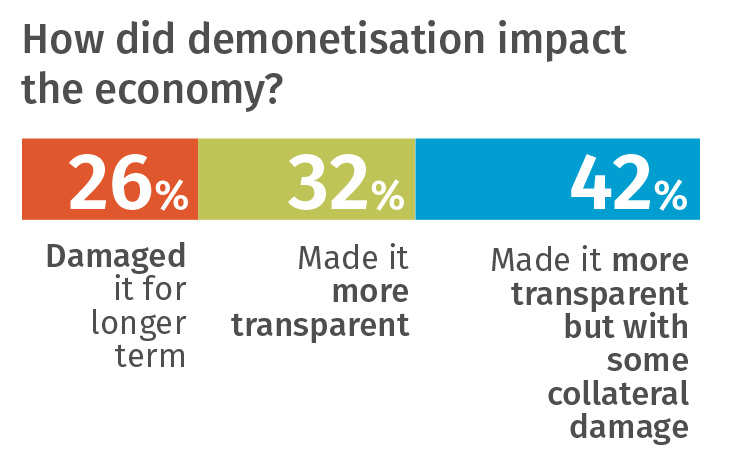

Only 26% thought demonetisation damaged the economy for longer term. 32% said it made the economy more transparent while 42% said it made the economy more transparent but with some collateral damage.

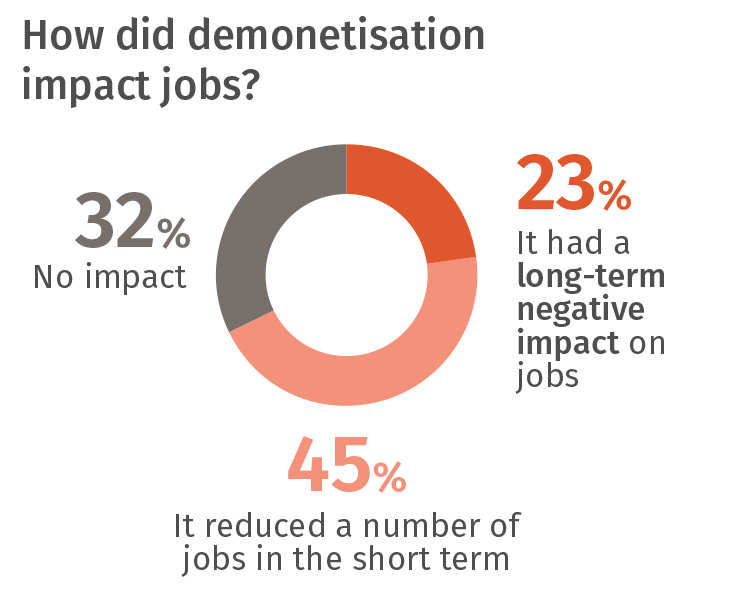

On the impact of demonetisation on jobs—a hot-button issue for Modi critics—only 23% said it had a long-term negative impact on jobs. 45% said it reduced a number of jobs in the short term while 32% said it had no impact on jobs. 77% not seeing any long-term loss of jobs due to demonetisation shows that most of the people don't buy into the argument that demonetisation killed jobs.

It's not clear if Modi has kept people by his side with his charismatic rhetoric despite failure of demonetisation or his opponents are plain wrong, but people don't see demonetisation as a decision that wrecked a growing economy.

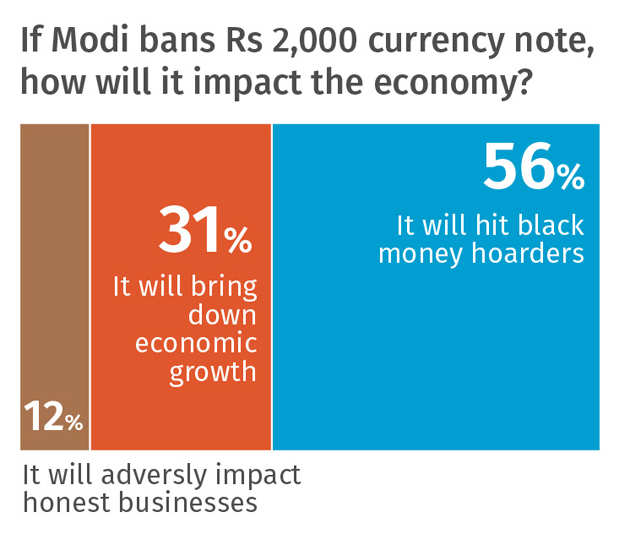

This is more evident from responses to the question, 'If Modi bans Rs 2,000 currency note, how will it impact the economy?'. 56% said it would hit black-money hoarders. 31% said it would bring down economic growth. 13% say it would adversely impact honest businesses. This means if Modi does another round of demonetisation, he is sure to have some popular support.

Despite massive criticism of demonetisation and its impact by experts

as well as common citizens, Modi has been able to convince people that

he took this step in larger public interest and not due to any vested

interest. In response to the question, 'What was Modi's real purpose

behind demonetisation?', 71% said his purpose was to reduce

black money

in the economy. 15% said it was to get the votes of the poor while 14% said it was to divert attention from communal issues.

The overall picture that the survey presents is this: demonetisation may have led to short-term pain but Modi did it in public interest and it has not ruined the economy.

Popular support was evident from post-demonetisation elections in Uttar Pradesh in which Modi helped his party win a landslide victory. If people continue to support Modi on demonetisation, it means critics of demonetisation in the opposition parties are themselves damaging their electoral prospects by barking up the wrong tree.

People most affected by Modi’s Anti-Black Money campaign

The country as a whole has been affected by the anti-black money campaign. As common citizens, we all had to face cash troubles and wait in long queues for ATMs, despite that, the move was supported largely. The targeted section of corrupt now face nightmares.

https://criticsunion.com/2016/11/11/10-people-affected-modis-anti-black-money-campaign/

Politicians

In Indian elections till about a decade ago booth capturing was the biggest problem. With time and efforts of election commission booth capturing was almost eliminated but electoral funding still remains a looming threat to our democratic system.

In Indian elections till about a decade ago booth capturing was the biggest problem. With time and efforts of election commission booth capturing was almost eliminated but electoral funding still remains a looming threat to our democratic system.

Fighting elections is a costly affair and the expenditure limits set up by election commission are unrealistic and barring a few almost all parties take anonymous donations from affluent business class and which is mostly tax evaded money. Obviously, donations from businessmen are paid back in terms of skewed policies and biased decisions in their favour.

Demonetisation along with the budgetary announcements by FM is a crucial step to reduce the amount of anonymous donations to parties from twenty thousand to two thousand rupees to curtail black money into politics.

Dravidian political parties are known to win elections on money power; one of them hardly conducts public meetings and only distributes money as evident in R K Nagar by poll caused by Jayalalithaa’s death.

Dravidian political parties are known to win elections on money power; one of them hardly conducts public meetings and only distributes money as evident in R K Nagar by poll caused by Jayalalithaa’s death.

Parties in Maharashtra are famous for giving tickets to real estate businessmen and mint their money. Similarly, UP is also known for regional parties using black money to fund elections by selling tickets.

Measures like demonetisation are set to deliver a big jolt to many of them as was evident in UP elections where some parties had less money to spend. Use of tax evaded money for donation to political parties to get undue favours in return is set to reduce in the times to come.

Demonetization will cause a cash crunch for political parties as most of them depended on black money. This would in turn open the debate for much needed electoral reforms that’s been pending for long and ultimately may be a step towards the cleansing of the system.

Demonetization will cause a cash crunch for political parties as most of them depended on black money. This would in turn open the debate for much needed electoral reforms that’s been pending for long and ultimately may be a step towards the cleansing of the system.

If politics does not require black money from corrupt people they may legislate and govern better and not hesitate from taking stern actions against corrupt businessmen, which would formalise the economy to a greater extent leaving the exchequer richer.

Hawala Dealers

The shadow economy created due to hawala dealings overburdens the honest, hardworking taxpayers who constitute mere one percent of the total population.

The shadow economy created due to hawala dealings overburdens the honest, hardworking taxpayers who constitute mere one percent of the total population.

Hawala trading is one of the major sources of black money. In hawala, the money is transferred from source to destination without actually moving it. It is a parallel illegal network where the money is given to an agent at the source and is collected from a network agent at the destination in exchange of a commission and government loses tax on such illegal transfers.

In most of the cases this is black money and thus to evade tax authorities this parallel route is used to transfer money. Audits reports and IT raids have proved that a large part of Indian economy is black and that the dishonest politicians, industrialists, bureaucrats have stashed huge amounts of illegal wealth in foreign banks in tax heaven countries.

Hawala trade has also received a punch as a result of demonetization. With demonetization rendering old currency notes invalid, the entire network is broken. Hawala traders are no longer accepting cash and transferring it to a destination because the currency is not a legal tender. Such money if deposited into banks would attract heavy penalties leaving that also as not a very good option.

This random action will result in great losses to such transactions which were outside the tax net and they may not be able to recover from it for long.

Real Estate Mafia

In towns, cities and metros, real estate is a big source of black money. In India, a large percentage of land deals are underreported.

In most of the cases this is black money and thus to evade tax authorities this parallel route is used to transfer money. Audits reports and IT raids have proved that a large part of Indian economy is black and that the dishonest politicians, industrialists, bureaucrats have stashed huge amounts of illegal wealth in foreign banks in tax heaven countries.

Hawala trade has also received a punch as a result of demonetization. With demonetization rendering old currency notes invalid, the entire network is broken. Hawala traders are no longer accepting cash and transferring it to a destination because the currency is not a legal tender. Such money if deposited into banks would attract heavy penalties leaving that also as not a very good option.

This random action will result in great losses to such transactions which were outside the tax net and they may not be able to recover from it for long.

Real Estate Mafia

In towns, cities and metros, real estate is a big source of black money. In India, a large percentage of land deals are underreported.

Whenever you go to a builder to see a flat, you always have to pay from 20 up to 40 percent of the cost in cash. No builder takes 100% cash and they are able to hide a significant part of their income from tax authorities. With demonetization, they will not be able to provide the sources of their illegally acquired money or face heavy penalties.

Also, with the increased use of technology in land records keeping it would make land deals more transparent. Also cases like Adarsh society scam will not happen with all government lands recorded in the system making it difficult for land hoarders to illegally make constructions on them.

Also, with the increased use of technology in land records keeping it would make land deals more transparent. Also cases like Adarsh society scam will not happen with all government lands recorded in the system making it difficult for land hoarders to illegally make constructions on them.

All these steps would break the builder politician nexus as well resulting in cheaper homes for home buyers. This will bring down the amount of black money in elections as well making it more possible for honest citizens to fight elections.

Benami properties transactions and illicit land dealings have created a stockpile of black money. Real estate goons project lands as agricultural lands and then transfer them as residential and make hefty profits.

Benami properties transactions and illicit land dealings have created a stockpile of black money. Real estate goons project lands as agricultural lands and then transfer them as residential and make hefty profits.

This whole game of power and political connections has virtually made it impossible for common man to afford house at otherwise affordable rates. But promises of action against benami properties has shocked real estate mafia and caught them unguarded. A considerable decline in real estate pieces proves the effectiveness of the policies enacted by Modi government.

Fake Currency Dealers

Another important motive achieved through demonetization is a curb on black money. Pakistan imports more ink and paper than it needs for currency printing for itself. ISI runs fake currency printing presses in Pakistan which is smuggled into India through Bangladesh and Nepal routes.

Another important motive achieved through demonetization is a curb on black money. Pakistan imports more ink and paper than it needs for currency printing for itself. ISI runs fake currency printing presses in Pakistan which is smuggled into India through Bangladesh and Nepal routes.

NIA studies show that fake currency notes worth rupees 400 crore are in circulation in India and a large portion of them are in the form of demonetized currency notes. The fake currency will have to be extinguished or brought into the banking system making their detection possible. In addition to that, the new 500 and 2000 rupee notes have world class security features making their duplication difficult for Pakistan so it’s a way to stay a step ahead of the copiers.

Demonetization move by the prime minister widened the tax net forcing people to make pan cards and adhaar cards and pay taxes. Fake currency is no longer available as a safe option like before and people want to avoid dealing with it. This would have a ripple effect and would reduce corruption and illegal activities in general. People fear Modi may be taking more steps in future to curb black money and hence may not prefer it.

Terrorist Organizations

The old notes were copied by Pakistan and used to finance terror in India. The new notes have advanced security features that may not be easy to copy for them for a long time. This is set to give a big blow to terror outfits that use this fake money to fund terrorists and export them to India.

Fake Currency Dealers

NIA studies show that fake currency notes worth rupees 400 crore are in circulation in India and a large portion of them are in the form of demonetized currency notes. The fake currency will have to be extinguished or brought into the banking system making their detection possible. In addition to that, the new 500 and 2000 rupee notes have world class security features making their duplication difficult for Pakistan so it’s a way to stay a step ahead of the copiers.

Demonetization move by the prime minister widened the tax net forcing people to make pan cards and adhaar cards and pay taxes. Fake currency is no longer available as a safe option like before and people want to avoid dealing with it. This would have a ripple effect and would reduce corruption and illegal activities in general. People fear Modi may be taking more steps in future to curb black money and hence may not prefer it.

Terrorist Organizations

The old notes were copied by Pakistan and used to finance terror in India. The new notes have advanced security features that may not be easy to copy for them for a long time. This is set to give a big blow to terror outfits that use this fake money to fund terrorists and export them to India.

Terrorists’ organisations like Hizb-ul-Mujahideen collect money in the form of donations in Pakistan and use Hawala routes to route it into India to carry out terror activities.

With demonetization the Hawala route is broken and it’s not possible for Pakistan to route money into India to spread terror. Their existing currency stacks in India face confiscation or may have to be extinguished. Their fake currency printing machines also printed mostly 500 and 1000 rupees notes that have been demonetised and new notes with advanced features may not be easy to duplicate.

Within weeks of demonetization, Kashmir became a more peaceful place extinguishing the cash from terror outfits. In fact, no internal riots and clashes took place in India for the period after demonetization as a result of cash crunch.

With demonetization the Hawala route is broken and it’s not possible for Pakistan to route money into India to spread terror. Their existing currency stacks in India face confiscation or may have to be extinguished. Their fake currency printing machines also printed mostly 500 and 1000 rupees notes that have been demonetised and new notes with advanced features may not be easy to duplicate.

Within weeks of demonetization, Kashmir became a more peaceful place extinguishing the cash from terror outfits. In fact, no internal riots and clashes took place in India for the period after demonetization as a result of cash crunch.

Sports Betting

Gambling in India is banned except lotteries but India have an illegal racket running nationwide that conducts betting on many things. The net turnover of illegal batting in India is estimated to be around $150bn and bulk of which is in cricket. Other things that have betting in India are movie performances on silver screen, election results, weather predictions etc.

IPL in cricket itself accounts for a large part of betting money in India. Indian bettors often have to transact money with foreigners. E-platforms such as Moneybookers and neteller are popular payment methods for such transactions. Online e-wallets are also used in which money is deposited by payees and it is then used to fund betting activities. Measures like demonetization have made circumventing the rules difficult as the cash depositors may be asked to reveal the sources of the money later.

As part of the income tax disclosure scheme, around 65 thousand crore rupees was declared but it is alleged that a large part of this illegal wealth still remains unearthed and after demonetization the part of this money that’s cash has become piece of paper. However, the effect of demonetization on the money stashed abroad in still unclear. This foreign money is estimated to be more than ten times the countries total debt. Gamblers and betting agents are having a hard time as e-transactions leave money trail for tracking and may invite troubles for them anytime in the future.

Educational Institutions

Indian education system is also a huge generator of black money every year. Capitation fees of around 50 thousand crore is paid at various educational levels from KG to PG in India.

This so generated black money often finds its ways to terrorism, election financing and religious conversions. Medical and engineering colleges are the biggest sources of black money with every seat going for lakhs of rupees. These educational institutes use that money to pay bribe to get accreditations from medical council and AICTE. Government has plans to conduct single common entrance exam to fulfil their seats which will reduce corruption. Auditing their financial statements, releasing them on websites, strict monitoring of their funds etc are some other measures set to reduce black money in educational institutes.

Thus, educational institutes can no longer have usual donation practices and there is looming fear in the minds of people related to all sectors that tax authorities are keeping strict vigil at their activities. This will definitely help poor parents to afford quality education for their children.

Fake Trusts and Charity

Fake trusts and charity are also a big source of black money in India. They are created sometimes only to turn black money into white. They take black money, evade taxes on them and instead of using that money for charitable purposes route it back to the donors after deducting a commission. While we can’t stop donations to charitable organisations, at least the large donations must not happen in cash.

They should be done by account payee cheques only and PAN number should always be accompanied in case of large donations. Politicians and businessmen use such trusts to launder their ill-gotten tax evaded black money into the system.

At least a million charitable trusts and private organisations misuse the rules to employ banking and other channels to launder money. Some fake NGO’s also exist; they conduct fake demonstrations where their ultimate aim is to launder money.

Tax enforcement measures and anti black money campaign by the current Modi government has proved effective in cleaning up the system. The manifesto promises, attitude of the government, and a series of significant systemic policy changes have seen drastic changes in the defiant mindset of black money hoarders. Auditing exercises across the nation, CAG reports and income tax raids have spoiled the party for fake NGOs and charity trusts.

Rich Agricultural Land Owners

In India, agricultural income is tax free but this channel is often misused to launder black money costing the exchequer in billions.

Tax enforcement measures and anti black money campaign by the current Modi government has proved effective in cleaning up the system. The manifesto promises, attitude of the government, and a series of significant systemic policy changes have seen drastic changes in the defiant mindset of black money hoarders. Auditing exercises across the nation, CAG reports and income tax raids have spoiled the party for fake NGOs and charity trusts.

Rich Agricultural Land Owners

In India, agricultural income is tax free but this channel is often misused to launder black money costing the exchequer in billions.

While it is true that a large number of farmers in India are poor, there exist few very rich land owners that masquerade as poor farmers. They, even if they are rich, enjoy all kinds of power and fertilizer subsidies, minimum support prices set up by the government to protect poor farmers, loan waivers and most of all- tax free income.

Rich farmers and such corporations are very influential in the government and bureaucracy and lobby against legislations that would pin them down. The system is hoodwinked by such farmers by buying cheap and uncultivable land. They would declare it to be cultivable land and thus all of their incomes become tax exempted. With the announcement of demonetization such large piles of illegally hoarded cash would become useless and poor farmers would benefit.

Another common practice is to buy subsidised agricultural land and convert it into residential land over a period with the help of people in influential positions or corrupt politician/bureaucrats. In this way, these affluent fake farmers purchase subsidised land at very low cost and sell them at hefty profits as residential land after conversion.

Another common practice is to buy subsidised agricultural land and convert it into residential land over a period with the help of people in influential positions or corrupt politician/bureaucrats. In this way, these affluent fake farmers purchase subsidised land at very low cost and sell them at hefty profits as residential land after conversion.

This directly impacts poor farmers as they are denied their right to low cost subsidised agricultural land and also it is loss of natural resources as fertile agricultural land is declared residential fictitiously.

The profits earned on these agricultural land deals are kept hidden from the system and become a statistics in black money figures.

But now, due to strict action on illegal land dealings, ‘benami’ transactions, ill wealth and action on corrupt bureaucrats by the Modi government have plugged the loopholes in the system. The fake farmers are looking for ways to dispose off their ill gotten wealth before the taxman can initiate criminal proceedings against them.

Film Industry

Film industry is another field where a lot of black money is involved. In a wikileaks cable in 2011, it got revealed that film industry welcomed the funds from politicians and gangsters who are looking to invest their ill-gotten funds.

In 2012, in a sting operation by cobrapost also showed film directors admitting that film industry uses black money to convert it into white. The IT act 1961 applies on the revenue sources of the film industry. Parts of it regulate TDS on all payments to directors, actors, studios and distributors as per sections 192, 194C, 194J etc.

By investing their tax evaded money into films, people may earn returns on them and which may in turn be used to conduct other illegal activities as well, in addition to tax losses to the country.

In 2012, a news website, Cobrapost’s sting operation caught directors admitting on record that how Indian film industry is working for black money to white conversion. Some of the big names in the industry have registered their companies outside India which is suspicious for Tax authorities.

Warnings, income tax declaration scheme, demonetisation, blocking routes to tax heaven countries, stress on e-transactions, aadhaar linking and GST implementation shows the intent and determination of the government to uproot black money and corruption. This incessant drive against illegal money has left corrupts people in the film industry puzzled and vulnerable.

Naxalites and Maoist Groups

Naxalites and such home grown anti social and internal terrorist groups want to destabilise government. They rely on extorted, unaccounted and ill gotten wealth from various illegal sources. On top of it they use this hard earned money of kidnapped or robbed people to carry out anti social and anti democratic violent activities that threatens the integrity and sovereignty of our country.

Naxalites and such home grown anti social and internal terrorist groups want to destabilise government. They rely on extorted, unaccounted and ill gotten wealth from various illegal sources. On top of it they use this hard earned money of kidnapped or robbed people to carry out anti social and anti democratic violent activities that threatens the integrity and sovereignty of our country.

Another benefit of demonetization is that Naxal financing has reduced. Naxalites used to extort money from people and used that money to illegally run their syndicate and execute violence. They may be left with cash that has become illegal now. Obviously, they must not have had bank accounts to deposit their cash in the system.

In 2012, a news website, Cobrapost’s sting operation caught directors admitting on record that how Indian film industry is working for black money to white conversion. Some of the big names in the industry have registered their companies outside India which is suspicious for Tax authorities.

Warnings, income tax declaration scheme, demonetisation, blocking routes to tax heaven countries, stress on e-transactions, aadhaar linking and GST implementation shows the intent and determination of the government to uproot black money and corruption. This incessant drive against illegal money has left corrupts people in the film industry puzzled and vulnerable.

Naxalites and Maoist Groups

Another benefit of demonetization is that Naxal financing has reduced. Naxalites used to extort money from people and used that money to illegally run their syndicate and execute violence. They may be left with cash that has become illegal now. Obviously, they must not have had bank accounts to deposit their cash in the system.

Less cash to such internal terrorists means not just monetary benefit but also it would help in maintaining peace and amity. Naxal affected regions are bereft of development, education, health services and government schemes. If Naxalism stops, the affected population can have access to normal and peaceful life. Also, the security personnel deployed to curb such acts of violence can be posted for some more productive and nation building tasks.

These moves have also forced people to disclose their legally earned money and deposit it into banks. The depositors will earn interests and at the same time their money would be safe. This will also increase banking culture among Indians and formalise the economy.

These moves have also forced people to disclose their legally earned money and deposit it into banks. The depositors will earn interests and at the same time their money would be safe. This will also increase banking culture among Indians and formalise the economy.

The banks may use the deposited cash for increasing economic activities such as lending to entrepreneurs which will increase employment in the country. It will open up a window for naxal families to join the mainstream banking system.

The large cash with the banks will also mean banks have more money to lend and thus home and car loans may become cheaper and thus manufacturing and real estate sectors may see a boom in the times to come. More people especially the underprivileged may be able to afford their own houses in the years to come as a result of demonetization.

Corrupt Bureaucrats

Bribery is a big way in India that generates black money. In schools, colleges, hospitals, pension offices, recruitment boards, electricity department, water department everywhere bribery is rampant. It is common belief these days that government job interviews can’t be cleared until bribe is paid.

A Transparency international study in 2005 showed that 62% Indians had paid bribe in their lives had paid bribes to get their tasks done in government offices. The same study in 2008 showed the number of bribe payer Indians to be 40%. A 2017 survey shows that seven out of 10 persons, who had to deal with public offices in India, had paid a bribe. Nearly 40% of the survey population believed that corruption has increased in last 12 months. A whopping 73 % of those who had paid a bride belonged to poor sections.

With demonetization, the cash stashed as a result of at least large bribes would be rendered useless and RBI would be extinguished of its liabilities. This measure would bring down the level of bribes in public offices in the future. Indian law has provisions to punish bribe takers in public offices but India also have a sprawling bureaucracy and a weak judiciary making it possible for dishonest bribe seekers get away with them.

Modi government has stressed on less cash economy and made systematic changes to encourage people to use e-wallets and e-transactions. In a less cash economy the bundles of black money cannot be stacked and taking bribes with an e-transaction is suicidal as it leaves a money trail and tax authorities can nab you anytime following the transaction route and cause. Therefore, cash is not available to offer bribes using black money to corrupt bureaucrats and they do not dare to take bribes using electronic channels due to fear of being tracked by audit and tax authorities.

Although demonetization was targeted to give a blow to corrupt people that have huge amounts of black money, the common man had to face great difficulties due to it. Only about 32% Indians have access to banks and there is just one bank on every 9500 Indians. The common people had to queue outside banks and ATM’s for hours. Often the ATM’s and banks would run out of cash leaving people more and more frustrated. The government had to face severe criticism from opposition parties and media for poor planning and implementation that wiped out 86% of the total volume of Indian currency. The people without bank accounts were the most severely affected. It is true that people were losing patience for the inconveniences faced yet most of them supported the prime minister for his far sighted intentions to fight black and counterfeit money.

COMMON MAN

As a result of demonetization, people started using their e-wallets, debit and credit cards and other online banking payment methods more and more.

Even after the country is fully remonetized, the people may not give up transacting using online methods. Thus it may prove to be a giant step towards making India a less cash economy.

A less cash economy is better in the sense that e-cash is safer to carry, makes giving bribes almost impossible and leaves behind a digital footprint forever that the tax agencies can relook at. It also makes tax evasion impossible as a result of which the country’s net tax net would increase and government will be left with more money to spend on public welfare and infrastructure related schemes.

More IT and banking jobs may be created for more and more and more banking and online transactions happening as a result of demonetization. Online accounts need technological infrastructure and maintenance and more people may be hired to perform such works in the future. This would generate employment opportunities for young professionals. India is fast becoming digital as a result of demonetization.

Black money was one of the reasons for inflation in India. Tax evaded income in the hands of the people would make the demand of goods go high in the market while the supplies remain the same. With a crackdown on black money through demonetization, the inflation is going to be under control in the future and the common man is going to benefit the most from this.

As a result of demonetization, defaulters in the areas like property tax, bank loans, electricity and telephone bills are rushing to pay in cash fearing if they didn’t do so the cash may become useless.

Additionally, government has implemented GST that would widen the tax net, make tax evasion almost impossible and is set to catalyse the economy. It is supposed to lift the growth rate by 2%. GST has reduced cascading tax effects from Indian consumers and that’s going to benefit them in future. The businessmen have to file taxes in a simple manner online leaving no room for harassment at the hands of tax authorities. It is set to increase the overall efficacy in logistics as now there is going to be one tax in the nation that is the destination based tax.

Also, as per the provisions in GST, less developed states get a boost. Multiplicity of taxes is eliminated as a result of GST and as a result of this consumers are going to benefit from increased market competition.

Actual voice and hope of common man in India

No comments:

Post a Comment