GST ready to roll under Modi Govt.

As India implements its Goods & Services Tax (GST) from the midnight of June 30, 2017; we start from a point where unorganised or informal economic activities account for nearly an incredible 92% of the country’s employment and make up an astounding 50% of its GDP!

The fundamental reform that the Modi government promised is well and truly going to start from midnight tonight. The essence of Modi Government's thrust has been to bring 'accountability' to the unorganized unaccountable Indian!

A recent World Bank Enterprises Survey noted that about half of the Indian firms believed that they were competing against informal firms, while malpractices of the informal sector were seen next only to obstacles such as corruption, power shortage and high levels of taxes.

The GST as an idea has existed from the time of Rajiv Gandhi. In 2000, the Vajpayee Government started a discussion on GST by setting up an empowered committee, headed by Asim Dasgupta, (Finance Minister, Government of West Bengal). The committee was given the task of designing the GST model and overseeing the IT back-end preparedness for its rollout. However, after all these years, it took a determined Modi Government to actually be able to implement it.

It is said that Mr.Modi as Chief Minister of Gujarat opposed the GST proposed by the then UPA government. But it has to be noted that Mr. Modi did not oppose the UPA II GST because it was against his or the BJP’s ideology. At the relevant Committee meeting in October 2013, Mr. Modi expressed his Government’s view through a Cabinet Minister of his. “The issues listed by him were revenue neutral rate, place of supply rules for goods and services, dual control, exemption, compensation, among others.” http://timesofindia.indiatimes.com/city/ahmedabad/Gujarat-opposes-GST-regime/articleshow/24559119.cms

And now that his NDA Government’s Bill had included all his views, he pursued its conversion into a law that is now in our statute books.

The GST is considered the most important milestone for the Modi government. It signals to investors the government's ability to deliver on its reform agenda. Once the GST is fully operational, it will be ground breaking and significantly change India's business environment since independence in 1947.A shift from unorganised to organised sector is thus seen as an major emerging theme for the stock market under the GST. The new tax regime will replaces 17 taxes such as central excise duty, service tax, value-added tax, and 23 cesses.

Analysts said the unorganised sector accounts of 50-70 per cent of market. No wonder, India is one big unorganized place.

Unorganised players hold market shares of

# 40-45 per cent in plastic and packaging sectors;

# 25-40 per cent in the electric equipment segments such as fans, lights, pumps, batteries and switchgears;

# 78 per cent of the dairy industry;

# 70 per cent of apparels;

# 75 per cent of jewellery and as high as

# 85 per cent in the diagnostic space.

Many of these players are engaged in malpractices where they claim input credit based on fake invoices, non-payment of taxes collected from customers and incorrect classification of goods in order to evade taxes. GST being a structural reform will alter the traditional unorganized business practices.

While the new tax regime will result in an increased shift from the unorganised to the formal economy, there will be uncertainty over the short term. The consumer segments (FMCG) are likely to have a near term impact.

Even as corporates are well-prepared with the IT systems, wholesalers and retailers are yet to transition to the new GST system. These channel partners could take 1-2 quarters to migrate to the new regime.

GST implementation will broadly usher in two major changes:

# either the unorganised sector will become organised and come under the tax net or

# companies that operate on thin margins will go out of business.

GST would be a huge positive for the stock market. The rates announced have been either a tad below existing levels or as per expectations, except for a few sectors.

The biggest beneficiaries of GST would be FMCG and retail, where rates have come down from existing levels. At the same time, availability of input credit will help companies lower effective tax rates significantly. They would also benefit from the shift from unorganised to organised sectors under the GST regime.

It will be a game changer for consumer staples, jewellery, paints, auto parts, pharma, hospitals diagnostics and agrochemicals sectors. Most of these sectors are already seeing a shift towards the organised sector, translating into larger market shares for the organised sector.

The country's biggest tax reform since independence is promising to bring millions of firms who don't pay any tax, into the tax net, boosting government revenues and India's sovereign credit profile.

The new tax will require firms to upload their invoices every month to a portal that will match them with those of their suppliers or vendors.

Because a tax number is needed for a firm to claim a credit on the cost of its inputs, many companies are refusing to buy from unregistered businesses. Those who don't sign up risk losing any customer who has.

Improved tax compliance should shore up public finances, augmenting resources for welfare and development spending and giving a lift to the $2 trillion economy. India currently has one of the worst tax-to-GDP ratios among major economies at 16.6 per cent, less the half the 34 per cent average for the members of the OECD and also below many emerging economies.

While there is no official estimate of the potential fiscal gain, some tax experts say the measure, after the initial teething trouble, would lift the tax-to-GDP ratio by as much as 4 percentage points as the number of tax filers is estimated to more than treble to 30 million.

The unorganised sector of India's economy is vast, providing employment to a shocking 9 out of 10 workers.

While staying outside the GST regime risks losing business, joining it will necessitate an overhaul of firms' accounting systems and an investment in technology.How will the GST rates—from 5% to 28% affect various sectors of the Indian Economy. A look at some of these sectors and how GST will impact them.

AUTOMOBILE:

The passenger car segment is expected to see an overall reduction in tax outgo, with bigger cars and sport utility vehicles (SUV) benefiting from lower tax rates.

CEMENT: A marginal tax relief

Contrary to expectations of cement firms, which were hoping for an 18% GST rate, the sector has been categorised in the 28% slab. Despite that, cement makers will see some relief in tax payout as the effective tax rate for packaged cement is anyway 29-31%.

CONSTRUCTION, REAL STATE: Input cost credit to offset higher rate

So far, the construction sector, including real estate, has had an effective tax outgo of between 11% and 18%. Under GST, the entire works contract is charged 18% tax. However, the sector is likely to gain from the input tax credit that is available under GST rules.

CONSUMER GOODS: Anti-profiteering measures to keep a lid on gains

Packaged consumer goods makers’ sales growth will be hit in the near term as trade channels have cut purchases in the run-up to GST. Overall impact is seen as neutral as rates have been cut on mass consumption items and hiked on higher-end products.

JEWELLERS: No dent to demand

The GST rate on gold jewellery has been fixed at 3%, lower than expectations of a 5% rate. The new rate is close to the current 2%. Hence, it should not affect consumer buying dramatically.

LUXURY HOTELS: High-end chains will pay more

From a pre-GST tax rate that varied between 18% and 25% based on state levies, GST classifies hotels into four buckets based on room tariffs. Those with room rates below Rs1,000 will be tax-exempt, although the rest will be taxed at 5%, 12%, 18% and 28%.

MULTIPLEXES: Input tax credit will bring benefits

Multiplexes are expected to benefit, primarily owing to input tax credit on fixed costs such as rent and common area maintenance. The GST rate has been fixed at 28% for tickets costing over Rs100.

TELECOM: Hit by higher tax burden

Telecom companies, already weighed down by high taxes and levies, now need to contend with an additional 3% tax with the shift to GST. A service tax of 15% applied to telecom services earlier.

VALUE FASHION: Gets a leg-up

The 5% GST rate on apparel priced below Rs1,000 is expected give a fillip to the value fashion business. Post GST, the entire value chain—raw material to the finished product—will come under the tax net.

There are some products whose prices will remain unchanged.

According to PTI, “The rates are in line with those finalised for goods.With this, rates of all items except a handful including gold, have been decided ahead of the roll out of the Goods and Services Tax (GST) regime from July 1.” The below list may undergo changes as it is subject to further vetting. GST rates for certain goods like textiles, footwear and precious metals are yet to be decided by the GST Council.

Live animals:

Live horses – 12% GST

GST exemption:

All goods other than live horses, such as live asses, mules and hinnies, live bovine animals, live swine, live sheep and goats, live poultry, that is to say, fowls of the species Gallus domesticus, ducks, geese, turkeys and guinea fowls. Other live animal such as mammals, birds and Insects.

Meat and edible meat offal:

GST of 12% on: All goods in frozen state and put up in unit containers, including, meat of swine, fresh or chilled, meat of sheep or goats, fresh or chilled; meat of horses, asses, mules or hinnies, fresh or chilled; edible offal of bovine animals, swine, sheep, goats, horses, asses, mules or hinnies, fresh or chilled; meat and edible offal, of the poultry of heading; other meat and edible meat offal, fresh or chilled; pig fat, free of lean meat, and poultry fat, not rendered or otherwise extracted, fresh, chilled.

Pig fat, free of lean meat, and poultry fat, not rendered or otherwise extracted, salted, in brine, dried or smoked put up in unit containers.

Meat and edible meat offal, salted, in brine, dried or smoked; edible flours and meals of meat or meat offal put up in unit containers

GST exemption:

All goods other than in frozen state and put up in unit containers. Meat of bovine animals, fresh and chilled. Meat of swine, fresh or chilled. Meat of sheep or goats, fresh or chilled. Meat of horses, asses, mules or hinnies, fresh or chilled. Edible offal of bovine animals, swine, sheep, goats, horses, asses, mules or hinnies, fresh or chilled. Meat and edible offal, of the poultry of heading, fresh or chilled. Other meat and edible meat offal, fresh or chilled. Pig fat, free of lean meat, and poultry fat, not rendered or otherwise extracted, fresh, chilled.

Fish, crustaceans, molluscs & other aquatic invertebrates:

Fish seeds, prawn / shrimp seeds whether or not processed, cured or in frozen state; all goods, other than processed, cured or in frozen state; live fish.

Fish, fresh or chilled, excluding fish fillets and other fish meat, fish fillets and other fish meat (whether or not minced), fresh or chilled; crustaceans, whether in shell or not, live, fresh or chilled; crustaceans, in shell, cooked by steaming or by boiling in water, chilled; molluscs, whether in shell or not, live, fresh, chilled; aquatic invertebrates other than crustaceans and molluscs, live, fresh, chilled; aquatic invertebrates other than crustaceans and molluscs, live, fresh or chilled;

5% GST: All goods (other than fish seeds, prawn/shrimp seed) processed, cured or in frozen state.

Dairy produce, bird’s eggs, natural honey, edible products of animal origin, not elsewhere specified:

5% GST: Ultra High Temperature (UHT) milk; Milk and cream, concentrated or containing added sugar or other sweetening matter including skimmed milk powder, milk food for babies, excluding condensed milk; Cream, yogurt, kephir and other fermented or acidified milk and cream, whether or not concentrated or containing added sugar or other sweetening matter or flavoured or containing added fruit, nuts or cocoa.

Whey, whether or not concentrated or containing added sugar or other sweetening matter; Products consisting of natural milk constituents, whether or not containing added sugar or other sweetening matter, not elsewhere specified or included. Chena or paneer put up in unit container and bearing a registered brand name. Birds’ eggs, not in shell, and egg yolks, fresh, dried, cooked by steaming or by boiling in water, moulded, frozen or otherwise reserved, whether or not containing added sugar or other sweetening matter; Natural honey, put up in unit container and bearing a registered brand name; Edible products of animal origin, not elsewhere specified or included.

12% GST: Butter and other fats (ghee, butter oil, etc.) and oils derived from milk, dairy spreads, cheese.

GST exemption

Fresh milk and pasteurised milk, including separated milk, milk and cream, not concentrated nor containing added sugar or other sweetening matter, excluding Ultra High Temperature (UHT) milk; eggs, birds’ eggs, in shell, fresh, preserved or cooked, curd, lassi, butter milk, chena or panneer other than put up in unit containers and bearing a registered brand name; Natural honey, other than put up in unit container and bearing a registered brand name.

Products of animal origin, not elsewhere specified or included:

GST exemption:

Human hair, unworked, whether or not washed or scoured, waste of human hair. Semen including frozen semen.

5% GST: Pigs’, hogs’ or boars’ bristles and hair; badger hair and other brush making hair; waste of such bristles or hair. Guts, bladders and stomachs of animals, (other than fish), whole and pieces thereof, fresh, chilled, frozen, salted, in brine, dried or smoked.

Skins and other parts of birds, with their feathers or down, feathers and parts of feathers (whether or not with trimmed edges) and down, not further worked than cleaned, disinfected or treated for preservation; powder and waste of feathers or parts of feathers.

Bones and horn-cores, unworked, defatted, simply prepared (but not cut to shape), treated with acid or gelatinised; powder and waste of these products.

Ivory, tortoise-shell, whalebone and whalebone hair, horns, antlers, hooves, nails, claws and beaks, unworked or simply prepared but not cut to shape; powder and waste of these products.

Coral and similar materials, unworked or simply prepared but not otherwise worked; shells of molluscs, crustaceans or echinoderms and cuttle-bone, unworked or simply prepared but not cut to shape, powder and waste thereof.

Ambergris, castoreum, civet and musk; cantharides; bile, whether or not dried; glands and other animal products used in the preparation of pharmaceutical products, fresh, chilled, frozen or otherwise provisionally preserved.

Animal products not elsewhere specified or included; dead animals of Chapter 1 or 3, unfit for human consumption, other than semen including frozen semen.

Live trees and other plants, bulbs, roots and the like; cut flowers and ornamental foliage:

GST exemption:

All goods.

Edible vegetables, roots and tubers:

GST exemption: Fresh vegetables, roots and tubers other than those in frozen or preserved state. Dried leguminous vegetables, shelled, whether or not skinned or split.

5% GST:

Herb, bark, dry plant, dry root, commonly known as jari booti and dry flower; Vegetables (uncooked or cooked by steaming or boiling in water), frozen. Vegetables provisionally preserved (for example, by sulphur dioxide gas, in brine, in sulphur water or in other preservative solutions), but unsuitable in that state for immediate consumption.

Manioc, arrowroot, salep, Jerusalem artichokes, sweet potatoes and similar roots and tubers with high starch or inulin content, frozen or dried, whether or not sliced or in the form of pellets.

Edible fruit and nuts; peel of citrus fruit or melons:

GST exemption: Fresh fruits other than in frozen state or preserved

5% GST: Dried areca nuts, whether or not shelled or peeled. All goods, other than dry fruits, in frozen state or preserved.

12% GST: Dry fruits

Coffee, tea, mate and spices. Mate a bitter infusion of the leaves of a South American shrub.

GST exemption: All goods of seed quality. Coffee beans, not roasted. Unprocessed green leaves of tea. Fresh ginger and fresh turmeric other than in processed form.

5% GST: Coffee, whether or not roasted or decaffeinated; coffee husks and skins; coffee substitutes containing coffee in any proportion, other than coffee beans not roasted. Tea, whether or not flavoured, other than unprocessed green leaves of tea. Maté. Pepper of the genus Piper; dried or crushed or ground fruits of the genus Capsicum or of the genus Pimenta. Vanilla.

Cinnamon and cinnamon-tree flowers. Cloves (whole fruit, cloves and stems). Nutmeg, mace and cardamoms. Seeds of anise, badian, fennel, coriander, cumin or caraway; juniper berries, other than of seed quality. Ginger other than fresh ginger, saffron, turmeric (curcuma) other than fresh turmeric, thyme, bay leaves, curry and other spices.

Cereals:

GST exemption: All goods (other than those put up in unit container and bearing a registered brand name).

Products of milling industry; malt; starches; inulin; wheat gluten.

GST exemption: Flour (aata, maida, besan etc. – other than those put up in unit container and bearing a registered brand name)

Wheat or meslin flour. Cereal flours other than of wheat or meslin, that is, maize (corn) flour, Rye flour, etc. Cereal groats, meal and pellets, other than those put up in unit container and bearing a registered brand name. Flour, of potatoes. Flour, of the dried leguminous vegetables of heading (pulses), of sago or of roots or tubers of heading or of the products of Chapter 8, that is, of tamarind, of singoda, mango flour.

5% GST: Cereal groats, meal and pellets, put up in unit container and bearing a registered brand name. Cereal grains otherwise worked (for example, hulled, rolled, flaked, pearled, sliced or kibbled), except rice of heading; germ of cereals, whole, rolled, flaked or ground [that is, of oats, maize or other cereals]; Meal, powder, flakes, granules and pellets of potatoes.

Meal and powder of the dried leguminous vegetables of heading (pulses), of sago or of roots or tubers of heading or of the products of Chapter 8 ,that is, of tamarind, of singoda, etc. Wheat gluten, whether or not dried.

12% GST: Starches; inulin.

18% GST: Malt, whether or not roasted.

1. Milk powder

2. Curd

3. Butter milk

4. Unbranded natural honey

5. Dairy spreads

6. Cheese

7. Spices

8. Tea

9. Wheat

10. Rice

11. Flour

12. Spices

13. Groundnut oil

14. Palm oil

15. Sunflower oil

16. Coconut oil

17. Mustard oil

18. Sugar

19. Jaggery

20. Sugar confectionery

21. Pasta

22. Spaghetti

23. Macaroni

24. Noodles

25. Fruit and vegetables

26. Pickle

27. Murabba

28. Chutney

29. Sweetmeats

30. Ketchup

31. Sauces

32. Toppings and spreads

33. Instant food mixes

34. Mineral water

35. ice

36. Sugar

37. Khandsari

38. Biscuits

39. Raisins and gum

40. Baking powder

41. Margarine

42. Cashew nuts Items of daily use

1. Bathing soap

2. Hair oil

3. Detergent powder

4. Soap

5. Tissue papers

6. Napkins

7. Matchsticks

8. Candles

9. Coal

10. Kerosene

11. LPG domestic

12. Spoons

13. Forks

14. Ladles

15. Skimmers

16. Cake servers

17. Fish knives

18. Tongs

19. Agarbatti

20. Toothpaste

21. Tooth powder

22. Hair oil

23. Kajal

24. LPG stove

25. Plastic tarpaulin

Stationery

1. Notebooks

2. Pens

3. All types of paper

4. Graph paper

5. School bag

6. Exercise books

7. Picture, drawing and colouring books

8. Parchment paper

9. Carbon paper

10. Printers

Healthcare

1. Insulin

2. X-ray films for medical use

3. Diagnostic kits

4. Glasses for corrective spectacles

5. Medicines for diabetes, cancer Apparels

1. Silk

2. Woollen fabrics

3. Khadi yarn

4. Gandhi topi

5. Footwear below Rs 500

6. Apparel up to Rs 1,000 Others

1. Diesel engines of power not exceeding 15HP

2. Tractor rear tyres and tubes

3. Weighing machinery

4. Static converters (UPS)

5. Electric transformers

6. Winding wires

7. Helmet

8. Crackers and explosives

9. Lubricants

10. Bikes

11. Movie tickets less than Rs 100

12. Kites

13. Luxury cars

14. Motorcycles

15. Scooters

16. Economy-class air tickets

17. Hotels with tariff below Rs 7,500

18. Cement

19. Fly ash bricks and blocks

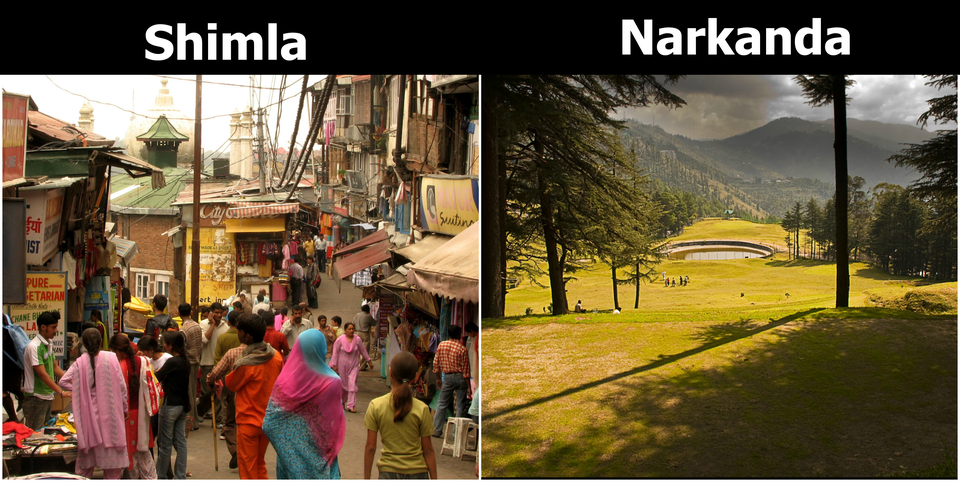

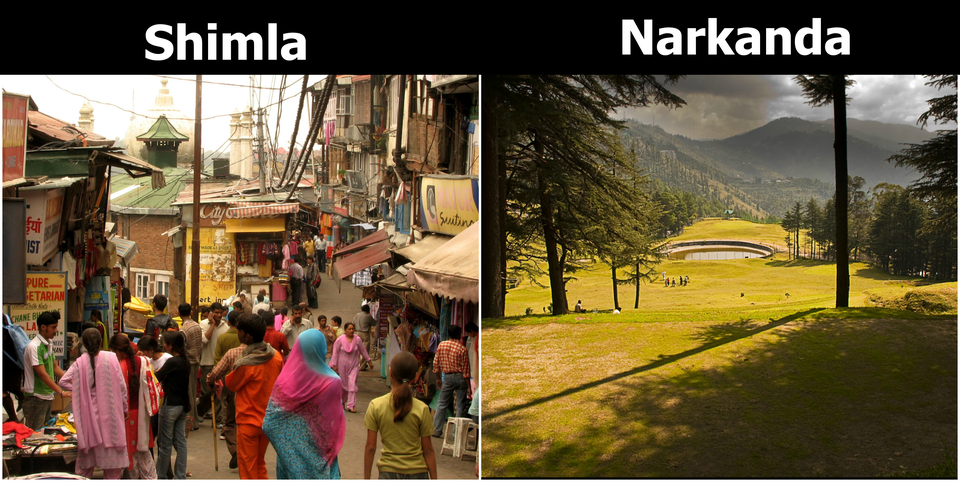

7 More Beautiful And Less Crowded Nearby Alternatives To Popular Hill Stations In India

7 More Beautiful And Less Crowded Nearby Alternatives To Popular Hill Stations In India Narkanda is just 60km ahead of Shimla!

Narkanda is just 60km ahead of Shimla! Credits: Airbnb

Credits: Airbnb 7 More Beautiful And Less Crowded Nearby Alternatives To Popular Hill Stations In India

7 More Beautiful And Less Crowded Nearby Alternatives To Popular Hill Stations In India Narkanda is just 60km ahead of Shimla!

Narkanda is just 60km ahead of Shimla! Credits: Airbnb

Credits: Airbnb Credits: Airbnb

Credits: Airbnb Credits: Airbnb

Credits: Airbnb Credits: Airbnb

Credits: Airbnb Credits: Booking

Credits: Booking Credits: Airbnb

Credits: Airbnb Credits: Airbnb

Credits: Airbnb Credits: Booking

Credits: Booking