2 years of Rajan: Analysts give 4.3 out of 5 to RBI governor

By Kshitij Anand, ECONOMICTIMES.COM | 5 Sep, 2015, 01.38PM IST

NEW DELHI: Analysts and economists gave a thumbs-up to Raghuram Rajan as he completed two years as governor of the Reserve Bank of India (RBI) on Friday. On a scale of 5, five analysts have given Rajan an average rating of 4.5.

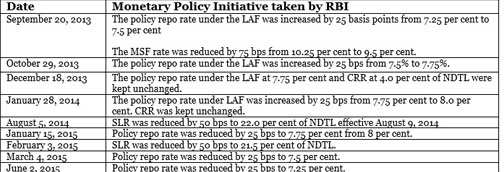

Raghuram Govind Rajan took charge as the 23rd governor of Reserve Bank of India on September 4, 2013 with a three-year term. In his first two years in office, inflation has come down, interest rate has eased to 7.25 per cent from 8 per cent in 2014, the forex kitty has swelled and the rupee has become more resilient. Plus, there have been two rounds of new bank licence awards, including the birth of an entirely new breed of banks in the country.

The former IMF chief economist, who had famously predicted the 2008 financial crisis in 2005, has also overseen some key reforms in monetary policy management and in the administration of the central bank.

India has been among the best-performing emerging markets amid a global currency rout against the dollar as emerging markets witness a major capital flight not seen since the collapse of Lehman Brothers in 2008.

"Dr Rajan's two years in office has been extremely valuable for the Indian economy. He has been successful in containing CPI inflation, managing inflation expectations and regaining investor confidence. The governor has also brought about some important changes to the monetary policy framework," said Dr Arun Singh from Dun & Bradstreet.

"The measures taken to bring about a resolution of the rising pile of stressed assets in the banking system will show results in the years to come," he said.

In the last one year, under his tenure, RBI granted banking licences to infrastructure financing firm IDFC and microfinance institution Bandhan.

Last month, the central granted 'in-principle' approval to 11 entities, including Reliance Industries, Aditya Birla Nuvo, Paytm, Vodafone andAirtel to set up payments banks and proposed such licences 'on tap' in future.

The governor has also managed to steer the economy through some of the toughest times. Having taken over the reins at a time of highfiscal deficit, high inflation and a vulnerable currency, Rajan has managed to restore investor confidence in the monetary policy and brought stability to the banking system.

"Independence and credibility of the central bank has been reaffirmed and international investors have poured record amounts into the Indian fixed income market over the past two years," said Mihir Vora, Director and Chief Investment Officer, Max Life Insurance.

"The rupee has behaved well in recent turbulent times and inflationary expectations are rapidly coming down, which is not a mean feat to achieve," Vora said.

Important Developments:

Movement of BSE Bankex in Rajan's first two years:

The S&P BSE Banking has rallied over 68 per cent from 10,964.19 in September 2013 to 18,437.50 in this September.

Accolades from global fund managers

One of the reasons investors across the globe favour India is that RBI has avoided the mistakes of other central banks, which have lowered interest rates to stimulate growth. The new government's prudence in managing its finances has also helped.

"One of the advantages that India has other than having the lot of smarter people is that your central banker (Raghuram Rajan) is probably the best central banker in the world, or at least the least bad central bankers in the world," Jim Rogers of Rogers Holdings said in an interview with ET Now last month.

"I always admire what I read, when he says things. Unfortunately, he is not the Indian government. He cannot save India, but you certainly have the least bad central banker in the world and I hope he continues being like that," he said.

Raghuram Rajan took over the job two years ago at a time when the rupee was in a precarious state, but the new governor nursed it back to health.

In an interview with ET Now in August, Marc Faber said he did not trust central bankers except that of India's, since he has a solid grip on monetary policies, while other monetary authorities around the world were basically money printers.

"Mr Raghuram Rajan is an outstanding man who understands central banking. He is probably only one in the world among the crowds of professors at central banks that actually has a good grip on monetary policies and what you can or cannot achieve with them. He should get the Noble Prize in economics. Others are all money printers at heart, all of them," Faber said.

Outlook on interest rates:

With inflation easing, a rate cut is in the offing. However, it may not come soon considering the global conditions. A lower interest rate can effectively bring about a turnaround in investment and hence growth, say experts.

"Considering the current global conditions, Mr Rajan may continue to hold interest rates at current levels, because a fall in interest rates could trigger flight of capital from India and would put pressure on the rupee," said Tushar of Right Horizons Financial Services.

In August, the Reserve Bank of India kept interest rates unchanged as expected but raised hopes of a reduction before the end of the year if the monsoon maintains its 'near-normal' progress. Rajan reintroduced the phrase "accommodative stance of monetary policy" after having dropped it in the June review.

"In the near future, we are expecting no change or a very slight change (approx 25 bps) in interest rate amid poor monsoon conditions and inflation," says Rohit Gadia, Founder & CEO, CapitalVia Global Research.

Sandeep Nayak ED & CEO, Centrum Broking, is of the view that the interest rate bias is downward. He expects interest rates to come down by 25-50 bps this financial year.

Outlook on the rupee:

The US dollar gained significantly against most international currencies during the year, but depreciated against the US dollar. The currency volatility began from August 11, when China devalued its yuan by 3.5 per cent, collectively.

The rupee has lost about 3.5 per cent since them. Speculations are rife that the country, struggling for export competitiveness, would make its currency further weaker.

The rupee, however, depreciated only marginally against the US dollar; by that token, it gained strongly against other major currencies, viz., euro, British pound and Japanese yen, reflecting a weak economic outlook for these economies and their ultra-accommodative monetary policies.

"The rupee is under pressure and will continue to remain so. Relative to the fall in other currencies, the rupee is better-off due to a controlled current account deficit on the back of benign oil prices," says Sandeep Nayak, ED & CEO, Centrum Broking.

"The rupee should remain rangebound between Rs 65 and Rs 67 against the US dollar in the short term, but it is difficult to predict the range for the medium term," he added.

Nayak is of the view that interest rate-sensitive stocks are out of favour right now, but barring real estate, he sees interest returning to auto and selectively bank stocks from a medium-term perspective.

The rupee is expected to remain at current level till the end of the calendar year 2015, say experts. Rate-sensitive sectors such as infrastructure, metals and power could face the heat, which would further impact the performance of banks, because all of them have exposure to these industries.

The outlook for the manufacturing sector would not improve anytime soon on the back of cheaper imports from China and other emerging countries, where the local currencies have weakened significantly.

"I believe investors should choose businesses that could get benefits from the rupee depreciation - such as pharma and IT/ITeS. The rupee is expected to remain at current levels till the end of calendar year 2015," said Pendharkar of Right Horizons Financial Services.

"In addition, consumption businesses such as FMCG, paints, consumer durables and auto could be better investment options in the current scenario," he said.

http://economictimes.indiatimes.com/markets/stocks/news/2-years-of-rajan-analysts-give-4-3-out-of-5-to-rbi-governor/articleshow/48834479.cms?prtpage=1

No comments:

Post a Comment